Doesn’t time fly? Or was it just that plenty happened in pharmacy this year? As we close out another year, it’s time for the annual review of Queensland pharmacy sales for 2023.

Before getting into the facts, figures and analysis of pharmacy sales, I have some news to share – this will be my final sales review. In future years, the responsibility will fall on our new AP Group team member, Stuart Ellis, who is working alongside me in Queensland.

Now, back to the report. As usual, the numbers are based on actual sales made by AP Group in Queensland. We look at:

- The capitalisation rates for metro and regional areas

- Average percentage sale price above valuation

- Average sale price for Queensland

- A comparison of results to previous years

A look back on our predictions

As always, we’ll start by looking back at last year’s predictions. Did we get it right? Or did we miss the mark?

For starters, we predicted that more owners would exit pharmacy in 2023 than 2022, however, numbers remained consistent with the previous year. Let’s look a little deeper into what else we found, including what changed or remained as the key market drivers impacting pharmacy sales.

- The Labour Government Minister for Health and Aged Care, Mark Butler, caught everyone by surprise when he announced the introduction of 60-day dispensing – without any warning or consultation with the Pharmacy Guild. Well, didn’t that create some turmoil and heated public debate between the Pharmacy Guild and the health minister? 60-day dispensing is here now, with phase one commencing on the 1st September and phase two starting in March 2024.

- Pharmacist shortages have continued in 2023 – this is widespread across Queensland and not limited to regional cities and country areas. Surprisingly, this has not impacted pharmacy sales and purchases.

- Interest rate increases by the Reserve Bank continued in 2023. Five rate rises increased the cash rate by 1.25% in 2023, putting further pressure on those with large mortgages. The reserve bank cash rate now sits at 4.35%.

As expected, after the 60-day dispensing news broke, the market faced disruption from May to August while pharmacists and pharmacy valuers waited for specific details about the new policy. Interestingly, we still had several pharmacy settlements during that period, and several other transactions that were paused mid-way through the process were resumed, settling in September and October.

As we’ve said before, the number of active and willing buyers in the market is dynamic. When one group or segment of buyers goes quiet, that creates an opportunity for other groups or individual buyers to re-enter the market. This is exactly what played out in 2023 following the announcement of 60-day dispensing. What never changes, is quality assets like pharmacies in prime locations with good future prospects. These will always be in high demand when listed on the open market, regardless of external factors.

On a bright note, 36% of pharmacies sold in 2023 went to first-time buyers (individuals) up from 25% in 2022. Junior partnership opportunities increased slightly in 2023, however, at times it’s challenging to find suitable potential managing partner candidates for regional cities and country towns. Metropolitan locations were a different story, with good candidates still keen on managing partnership opportunities.

Analysis & Data

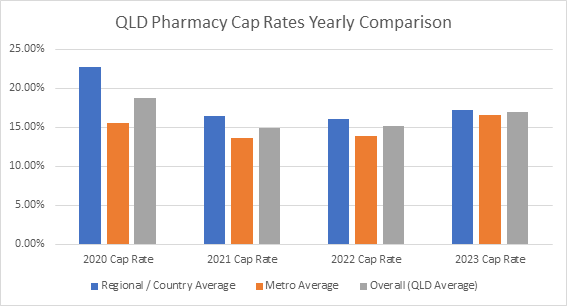

| QUEENSLAND | 2020 Cap Rate | 2021 Cap Rate | 2022 Cap Rate | 2023 Cap Rate |

| Regional / Country Average | 22.74% | 16.50% | 16.10% | 17.29% |

| Regional / Country Range | 17.5% to 27.2% | 13.9% to 18.9% | 14% to 20% | 16.1% to 19.4% |

| Metro Average | 15.61% | 13.59% | 13.90% | 16.57% |

| Metro Range | 15.1% to 16.7% | 12% to 16.15% | 13.1% to 15.1% | 12.8% to 24.6% |

| Overall (QLD Average) | 18.78% | 14.88% | 15.21% | 16.96% |

| Average Sale Price | $1.37M |

Special Note -: If a pharmacy was purchased based on the sum of its assets or just for the PBS approval number, it has been excluded. Only pharmacies sold using the traditional FME valuation methodology were included in the analysis above. No pharmacies were sold on the sum of their assets in 2023.

Metro -: (Brisbane, Gold Coast & Sunshine Coast)

Regional / Country -: (All other parts of QLD)

Observations and Conclusions

QLD average Sold Price above Valuation in 2023: 8.39%

Metro average Sold Price above Valuation in 2023: 12.57%

Average sale price in QLD: $1.37M

Metro: The average metro cap rate was higher in 2023, still coming off the post covid cap rates in the thirteens. However, if we exclude one result (the upper range of 24.6%) the average cap rate for metro comes out at 14.55%. This is still an excellent result. The results include a number of sales made following the 60-day dispensing announcement, proving quality pharmacies in Brisbane can still achieve premium prices.

Astute pharmacy buyers know the longer-term value in pharmacy ownership, with several of the larger groups not slowing their acquisitions in 2023, and with plans to continue buying in 2024. Smaller community strip pharmacies and medical centre style pharmacies continue to be the entry point for individual first-time buyers – those who are confident to back themselves see a bright future for pharmacy.

Regional: The cap rate for regional and country pharmacies sold in 2023 increased by one per cent to 17.3% – this is up from the low mark of 16.1% in 2022. This is to be expected coming off the back of Covid. As with previous years, this result did not include any small, single pharmacy towns that might push the average cap rate higher.

Other factors impacting the sale of pharmacies in regional and country areas are:

- The shortage of pharmacists in these parts of the state has driven up pharmacist wages and the cost of locums, having a direct impact on the profitability of these pharmacies.

- The groups and buyers willing to look at good pharmacy opportunities in regional cities are hesitant to proceed unless they have a managing partner or pharmacist already lined up. In many cases, the pharmacist and owner selling are often retiring or not wanting to keep working 6 days a week, so there’s a high risk of not finding a pharmacist to replace them.

- For pharmacies receiving remote pharmacy maintenance, RPMA payments doubled from 1 July 2023. What’s more, the pharmacies that qualified for the regional pharmacy transition allowance to offset the impact of 60-day dispensing will receive additional funds from the government. This will help maintain the valuable services these pharmacies provide to regional and remote communities. Not a bad time to own a regional or country pharmacy.

Predictions for 2024

What will 2024 bring for pharmacy sales? To be honest, I’m not sure. A lot will depend on the outcome of the next Guild Government Agreement, which has been brought forward to March 2024 instead of 2025. This was a compromise by the government after the outcry from community pharmacists when 60-day dispensing was announced without any consultation with the Pharmacy Guild.

If the 8th CPA is positive and includes some measures to off-set some of the negative impacts of 60-day dispensing (like lost revenue and lost profits), that could be the catalyst for an increased number of owners to sell. If the 8th CPA is delayed or is more of the same but with increased funding for professional services, then pharmacy sales are likely to continue at the current levels.

Here’s what we believe will be the key market drivers in 2024:

- Positive sentiment and confidence is slowly returning, as the impact of 60-day dispensing on pharmacy businesses is shown to be less than first thought when it was originally announced. History shows how resilient and adaptive pharmacy owners are in adapting and making changes to their business models to achieve longer term growth and profitability.

- Greater opportunity for new entrants to ownership, with first-time buyers getting a chance while some pharmacists are hesitant. When things are going well for pharmacy, the competition for pharmacies that come to market increases and drives prices higher, leaving inexperienced first-time buyers unable to compete with the larger groups or owners with equity.

Pressure on owners due to pharmacist shortages has gone on for a few years now and it’s starting to take a toll. Some owners have had enough and won’t want to change or adapt their business models.

- Five rate increases by the Reserve Bank in 2023, off the back of eight rate increases in 2022, could start to worry some owners that aren’t seeing growth in their pharmacies.

In 2023, our AP Group partnership program saw four potential managing partners start their trial periods and one partnership commence and settle. In 2024, the AP Group team will continue to put resources behind promoting our managing partnership program, with a series of podcasts and more exposure on our new AP Group website launching in 2024.

Listening to the growth and expansion plans of some of the larger independent pharmacy groups for 2024, as well as the level of interest from first-time buyers to secure pharmacy ownership, we believe 2024 will see a healthy level of pharmacy sales and managing partnership opportunities.

I’m looking forward to 2024 together with my colleague, Stuart Ellis. We’d love to assist you in your pharmacy ownership journey.

If you’d like to discuss any of the views, opinions or observations expressed in this article, I’d love to hear from you. Please feel free to contact me directly at ian@apgroup.com.au

Written by Ian Fedrick, QLD & NT Sales Manager – AP Group

AP Group are the leading pharmacy experts in Australia and specialise in helping first time buyers find the right pharmacy and secure the finance to support their purchase.

We connect existing owners with over 5000 ready and eager investors via our cutting-edge online Data Room. Our Data Room keeps confidential listing data secure and allows buyers to make informed decisions on each of our pharmacies for sale.

AP Group have built connections with all the major banks and a host of smaller lenders, ensuring that first time pharmacy buyers find a better deal.

About the Author:

Sports enthusiast and self-confessed lawn addict, Ian spends his spare time keeping fit and tending to his freshly manicured front lawn. What’s good news for you, he puts the same amount of care and attention toward his pharmacy clients — having sold more than 120 pharmacies across all parts of Queensland and NT.

Having worked in the pharmaceutical industry for more than 40 years, we’re yet to find anyone in Queensland who’s better placed to help you with your pharmacy sale, purchase or junior partnership. Ian’s career began at Alphapharm in 1984 as one of their first employees, and since this time he’s held several roles in the industry — including sales management roles and being part of the Arrow Pharmaceuticals entrepreneurial team that shaped an emerging private prescription market in Australia and re-invented generics through cross-licenced products.

Ian established IF Business Broking in 2008, building it from start up to one of the most successful pharmacy broking businesses in Queensland. In 2019, IF Business Broking merged with AP Group, which marks the beginning of his time here.

What really shines through with Ian is his genuine passion for helping people — whether you’re the experienced pharmacist looking to wind down and retire, or the young and energised pharmacist looking to make their first purchase.